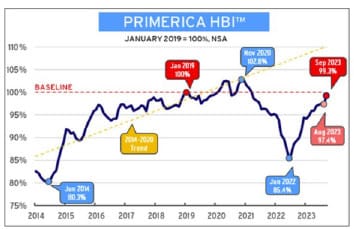

Since 2020 we have all been experiencing very little left over, if any after our monthly living and debt service. Some have even dipped into their savings or even taken on debt, to buy food, gas, taxes, necessities and service their debt. Upon the continued rise of inflation and the increased cost of consumer goods since mid-2021 this gap between purchasing power and wages has only gotten wider with very little relief forecasted in the future. Let’s take a look at the latest data provided by “the Primerica Household Budget Index (HBI).

“Primerica created the monthly Household Budget Index (HBI) I™ to fill the need for a reliable and consistent measure to track the purchasing power of middle-income families with incomes between $30,000 to $130,000. Understanding middle-income families’ purchasing power is important because it directly impacts their ability to save money vs. increase debt. The HBI™ measures how the current economic climate affects families’ ability to afford necessities, including food, gas, utilities, and health care. The cost of these items can vary month-to-month because of economic and other events, such as global trade issues, weather issues, animal and plant diseases, pandemics, and international conflicts. These factors create supply and demand imbalances, which can lead to big price changes.”

“The HBI™ is presented as a percentage. If the index is above 100%, the purchasing power of middle-income families is stronger than in the baseline period and they may have extra money left over at the end of the month that can be applied to things like entertainment, extra savings, or debt reduction. If it is under 100%, households may have to reduce overall spending to levels below budget, reduce their savings, or increase debt to cover expenses. The HBI™ uses January 2019 as its baseline. This point in time reflects a recent “normal” economic time prior to the COVID-19 pandemic.”

As we take a look at the data presented below by the Primerica HBI, November 2020 indicated a 103.8% surplus for purchasing power. A generous 3.8% surplus for entertainment or additional wants in the household. After the onset of inflation in mid-2021, the percentage for January 2022 dropped to 84.5%. The purchasing power of the family was approximately 15.5% below their projected needs for necessities. Many households found themselves dripping into their savings accounts or taking on additional debt or even just simply doing more with less to meet their needs. There was an improvement in August of 2023 of 97.4%. Even though an improvement the households are still below their breakeven point for their monthly necessity needs. The percentage in September of 2023 at 99.3% is almost at a break-even point but still not quite breaking even.